contra costa county sales tax rate 2019

Costa detail of tax rates 2018-2019 robert campbell county auditor-controller martinez california. Contra Costa County has one of the highest median property taxes in the United States and is ranked 72nd of the 3143 counties in order of median.

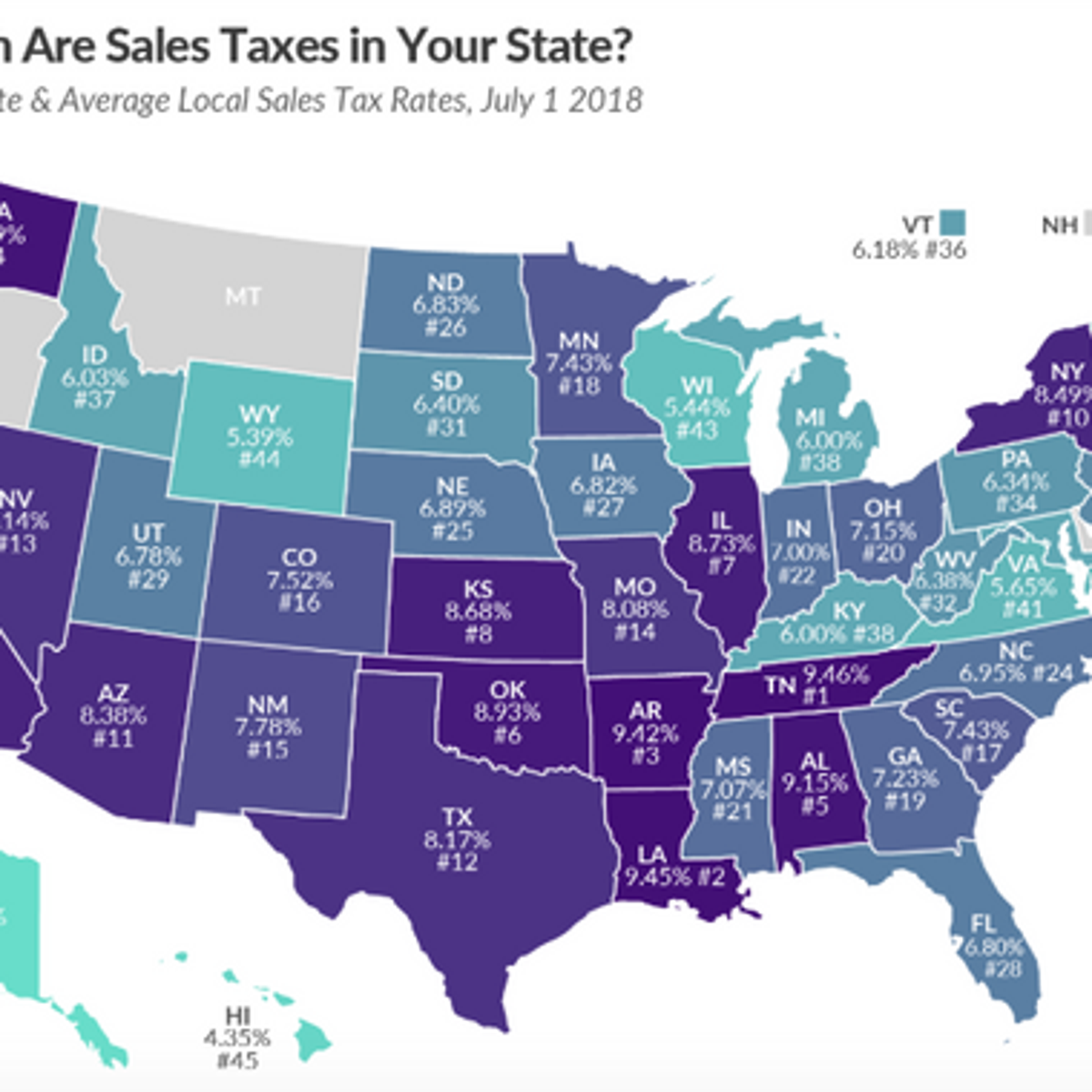

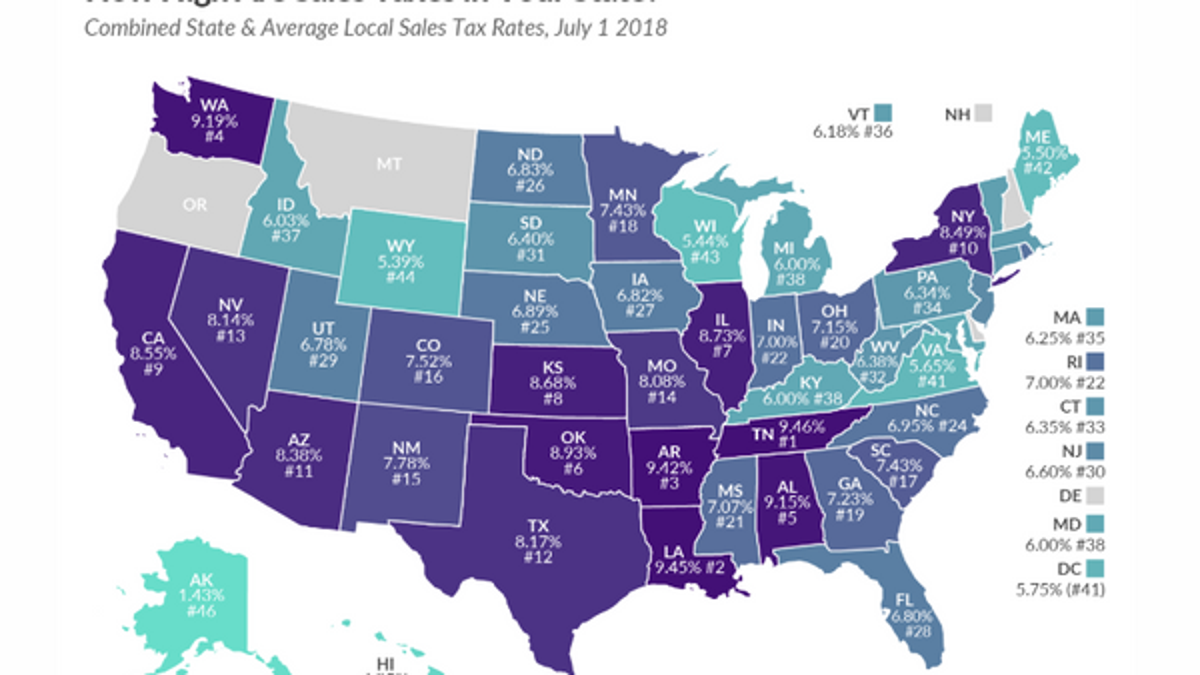

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

The California state sales tax rate is currently 6.

. Sales Tax Breakdown. The California state sales tax rate is currently 6. And the development of the tax rate area TRA annual tax increment ATI apportionment factors which determine the.

DETAIL OF TAX RATES 2018-2019 ROBERT CAMPBELL COUNTY AUDITOR-CONTROLLER MARTINEZ CALIFORNIA. 2019-2020 tax rates by tax rate. Prime TRA CityRegion Cities 01000 Antioch 02000 Concord.

Higher sales tax than 88 of California localities. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County. The Contra Costa County sales tax rate is 025.

The minimum combined 2022 sales tax rate for Contra Costa County California is. COUNTY OF CONTRA COSTA DETAIL OF TAX RATES 2019-2020 ROBERT CAMPBELL COUNTY AUDITOR-CONTROLLER MARTINEZ CALIFORNIA. A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax.

Located in Contra Costa County 1. The Contra Costa County sales tax rate is. District 201920 Tax Rate Maturity Acalanes Union 1997 00118 2023-24 Acalanes Union 2002 00208 2024-25.

The minimum combined 2020 sales tax rate for Contra Costa County California is 825. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 2 P a g e Note. This is the total of state and county sales tax rates.

For more information on how to. The Contra Costa County Sales Tax is 025. Local sales and use tax rate changes took effect in Oklahoma on April 1 2019.

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. The 94595 Walnut Creek California general sales tax rate is 825. 94518 94519 94520.

This is the total of state and county sales tax rates. Alamo 8250 Contra Costa Albany 9750 Alameda Alberhill Lake Elsinore 7750 Riverside. Next to city.

The current total local sales tax rate in Concord CA is 9750. The Contra Costa County Sales Tax is collected by the merchant on all. Dozens of local sales tax rate changes set to hit California on April 1.

Contra Costa County collects on average 071 of a propertys assessed fair market value as property tax. Contra Costa County sales taxes vary by local jurisdiction presently collecting 825 to 975 already. This is the total of state and county sales tax rates.

Mar 22 2019 Gail Cole Share. Click to see full answer. New Sales and Use Tax Rates Operative April 1 2019.

The current total local sales tax rate in Contra Costa County CA is 8750. Heres how Contra Costa Countys maximum. Concord is in the following zip codes.

The minimum combined 2020 sales tax rate for Contra Costa County California is 825. Concord Details Concord CA is in Contra Costa County. The county sales and use tax rate in Carter County increased from 75 to 875 for a total rate of 5375.

CONTRA COSTA COUNTY Audit Report APPORTIONMENT AND ALLOCATION OF PROPERTY TAX REVENUES July 1 2015 through June 30 2018. In Beckham County the county sales and use tax rate changed from 25 to 35 for a combined state and local rate of 485. The median property tax in Contra Costa County California is 3883 per year for a home worth the median value of 548200.

The combined rate. From 725 to 825. The December 2020 total local sales tax rate was 8250.

-025 lower than the maximum sales tax in CA. The minimum combined 2020 sales tax rate for Contra Costa County California is 825. This is the total of state and county sales tax rates.

Fast Easy Tax Solutions. SB 1349 enables more such circumvention of. Rates Effective 10012018 through 03312019 City Rate County Avalon 10000 Los Angeles Avenal 7250 Kings.

Share to Facebook Share to. Alamo 8250 Contra Costa Albany 9750 Alameda Alberhill Lake Elsinore 7750 Riverside. Ad Find Out Sales Tax Rates For Free.

From 875 to 925. So some parts of the County have a sales-tax rate 25 higher than the statutory 2 add-on cap. The December 2020 total local sales tax rate was 8750.

Prime TRA CityRegion Cities 01000 Antioch 02000 Concord 03000 El Cerrito 04000 Hercules. The California state sales tax rate is currently 6. Some cities and local governments in Contra Costa County collect additional local sales taxes which can be as high as 45.

The Contra Costa County sales tax rate is 025. How 2019 Sales taxes are calculated for zip code 94595. Contra Costa Water Land Levy 00028 - East Bay Regional Park 00021 2033-34 John Swett 2002 00234 2025-26.

Language other than English spoken at home percent of persons age 5 years 2016-2020. How does the Antioch sales tax compare to the rest of CA. California sales tax rate changes April 2019.

The California state sales tax rate is currently. 72 rows located in Contra Costa County 1. The county hopes.

The minimum combined 2020 sales tax rate for Contra Costa County California is 825. Contra Costa County passed its first transportation sales tax Measure C in 1988 and extended it through the subsequent Measure J half-cent sales tax which expires in 2034. The 975 sales tax rate in Antioch consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Antioch tax and 25 Special tax.

The tax rate changes listed below apply only within the indicated city or county limits. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 1 P a g e. City of Martinez located in Contra Costa County 654.

Our audit found that Contra Costa March 27 2019.

Sales Taxes How Much What Are They For And Who Raised Them

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Understanding California S Sales Tax

California Sales Tax Rate Changes April 2019

Understanding California S Sales Tax

Understanding California S Sales Tax

California Sales Tax Rates By City County 2022

Understanding California S Sales Tax

Sales Taxes How Much What Are They For And Who Raised Them

California City County Sales Use Tax Rates

Restricted Stock Units Jane Financial

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Sales Taxes How Much What Are They For And Who Raised Them

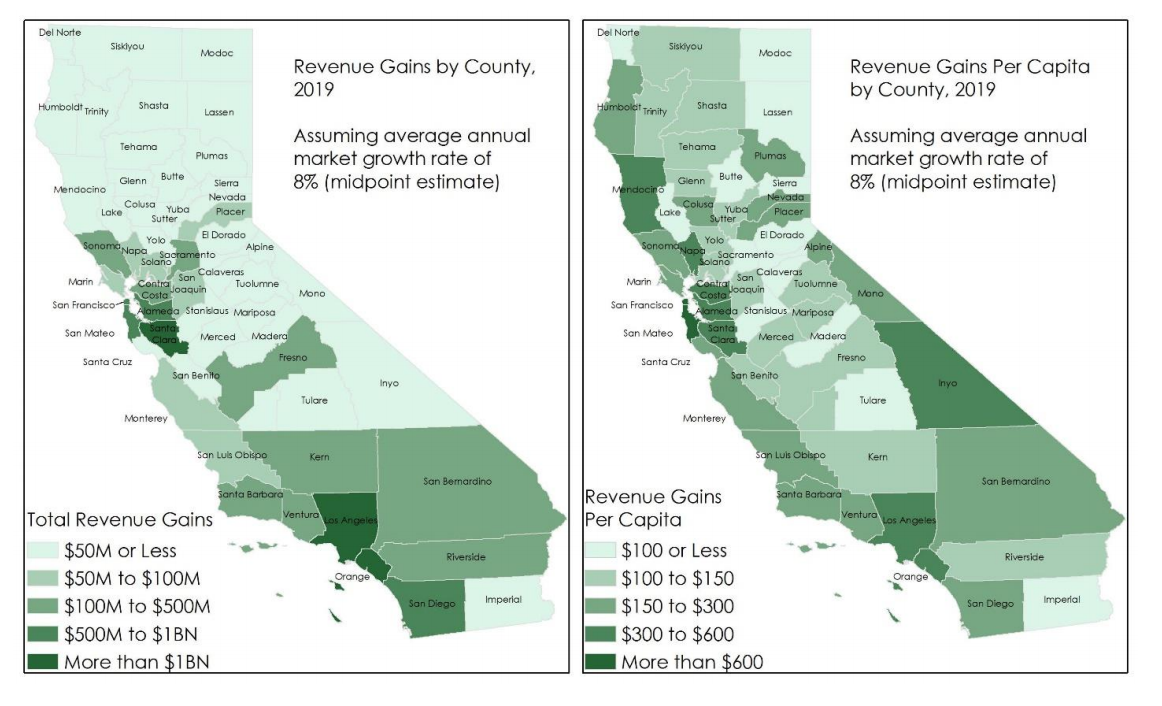

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review